Open house events in the real estate industry offer a unique opportunity for potential buyers to explore a property. However, with the excitement comes the need for adequate insurance coverage to protect both property owners and visitors.

In this article, we will delve into the intricacies of Openhouseperth.net insurance, highlighting its importance, coverage options, and key considerations for a successful event.

Importance of Insurance for Open House Events

Open house events are not without risks. From accidental property damage to unforeseen liabilities, having insurance in place is crucial. These events often involve multiple visitors who can unintentionally cause damage to the property, and in some cases, accidents can lead to injuries. Without proper insurance, property owners may face significant financial burdens from repairs, legal fees, and medical expenses.

Securing insurance before hosting an open house is essential for mitigating these risks. Insurance acts as a financial safety net, ensuring that any unexpected incidents do not lead to severe financial loss. This proactive step not only protects the property owner but also provides peace of mind to visitors, knowing that their safety and well-being are considered.

Coverage Options for Openhouseperth.net insurance

Property Insurance

Property insurance forms the backbone of Openhouseperth.net insurance, covering damages to the physical structure and belongings.

We’ll explore the various aspects of property insurance, emphasizing its role in protecting against natural disasters, vandalism, and more.

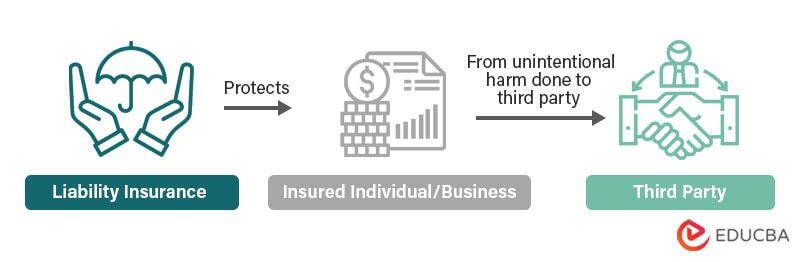

Liability Insurance

Liability insurance is equally vital, offering protection against third-party claims.

This section will outline the types of liabilities covered, such as injuries sustained on the property or damage caused by the event attendees.

Choosing the Right Insurance Provider

Research and Reviews

Selecting the right insurance provider is a critical decision. We’ll discuss the importance of thorough research, reading reviews, and considering recommendations to ensure a reliable and reputable insurance partner.

Customization Options

Every open house event is unique, and insurance should be tailored to specific needs. This section will guide readers on customizing insurance plans to suit the characteristics of their property and event.

Common Misconceptions about Open House Insurance

Addressing misconceptions is vital for a comprehensive understanding of Openhouseperth.net insurance. One common myth is that homeowners’ insurance is sufficient for covering open house events. However, standard homeowners’ insurance often does not include specific coverages needed for events involving multiple visitors. Another misconception is that open house insurance is excessively expensive, deterring property owners from securing proper coverage. In reality, insurance plans can be tailored to fit various budgets, offering essential protection without significant financial burden. By debunking these myths, property owners can make informed decisions about securing adequate insurance.

also read: What Is ads.xemphimon@gmail.com? – its Impact In 2024

Tips for a Successful Open House Event

Security Measures

Ensuring the safety of visitors and property requires proactive security measures. Implementing professional security services, surveillance systems, and controlled access can significantly enhance event security. Security personnel can monitor visitor activities, deter potential vandals, and respond promptly to any suspicious behavior. Additionally, using modern surveillance technology such as CCTV cameras provides real-time monitoring and a record of the event, further enhancing safety and security.

Emergency Preparedness

Unforeseen emergencies can arise, making preparedness essential. Having a first aid kit on-site and training staff on basic first aid procedures ensures quick response to any medical emergencies. Establishing clear communication plans, including emergency contact numbers and evacuation routes, helps in managing various scenarios effectively. Preparing for emergencies not only ensures the safety of visitors but also demonstrates a commitment to their well-being, enhancing the overall experience of the open house event.

Real-Life Scenarios: Benefits of Open House Insurance

Natural Disasters

Illustrating the real-world impact of open house insurance, we’ll delve into a case study involving a property affected by a natural disaster. Imagine a scenario where a sudden storm causes significant damage to the property during an open house event. The insurance coverage’s role in recovery and restoration will be highlighted, showcasing how it enables the property owner to quickly address damages, ensuring minimal disruption to their real estate plans and financial stability.

Accidents on the Property

Another case study will explore scenarios where accidents occur during open house events, emphasizing how liability insurance steps in to mitigate potential legal and financial consequences. For instance, if a visitor slips and falls, resulting in an injury, liability insurance covers the medical expenses and any legal fees that may arise from a lawsuit. This protection allows property owners to focus on hosting successful events without the constant worry of unforeseen accidents and their repercussions.

Cost Considerations and Budgeting

Understanding the costs associated with Openhouseperth.net insurance is essential for budgeting. Several factors influence insurance costs, including the property’s location, size, value, and the type of coverage required. Property owners should obtain quotes from multiple insurance providers to compare costs and find the most competitive rates. Additionally, discussing potential discounts or bundling options with insurers can help in managing expenses effectively. By planning and budgeting for insurance, property owners can ensure comprehensive coverage without straining their financial resources.

Legal Requirements and Compliance

Navigating the legal landscape is crucial for open house events. Different regions have varying legal requirements regarding insurance for public events. It’s essential for property owners to research and comply with local regulations to avoid legal issues.

Insurance plays a significant role in ensuring compliance, providing the necessary documentation and coverage to meet legal standards. By adhering to these requirements, property owners can host open house events confidently, knowing they are legally protected.

Navigating the Claims Process

In the unfortunate event of a claim, understanding the claims process is vital. This section will guide readers on what to expect and how to navigate the claims process seamlessly. Property owners should promptly report any incidents to their insurance provider, providing detailed documentation and evidence of the damage or injury. Working closely with insurance adjusters and following their instructions ensures a smooth and efficient claims process, leading to timely compensation and resolution.

also read: Exploring pépico – The French Soft Drink Experience

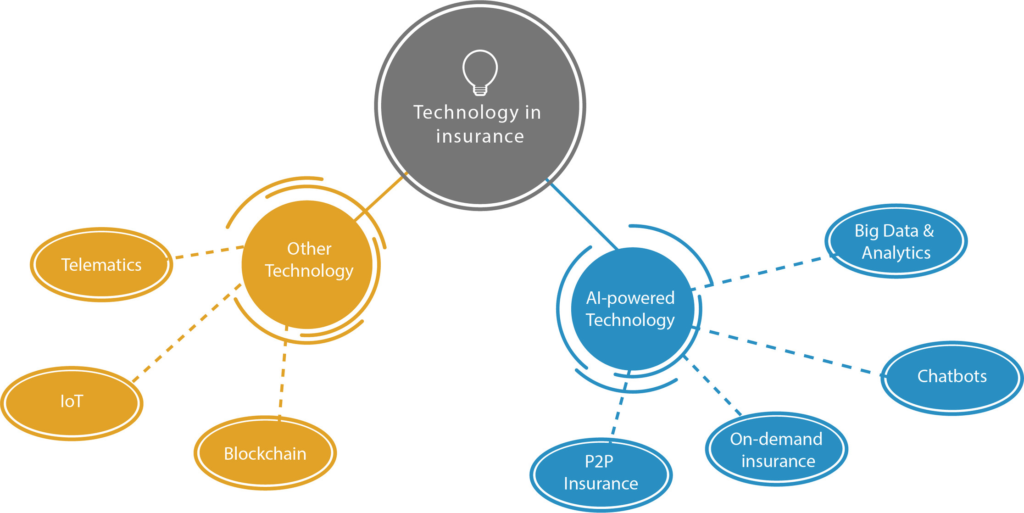

Industry Trends and Updates

Staying informed about industry trends is key to making informed decisions. We’ll explore the latest developments in open house insurance, including emerging coverage options and technological advancements. Innovations such as digital claims processing, smart home integrations, and enhanced risk assessment tools are revolutionizing the insurance industry, offering more efficient and comprehensive coverage options. By staying updated on these trends, property owners can leverage new opportunities to enhance their insurance strategies.

The Role of Technology in Open House Insurance

Technology plays a significant role in enhancing the effectiveness of Openhouseperth.net insurance. This section will discuss how innovations such as digital documentation, smart security systems, and data analytics contribute to a more robust insurance strategy.

Digital documentation streamlines the claims process, while smart security systems provide real-time monitoring and alerts, enhancing event safety. Data analytics helps in assessing risks accurately, allowing for more tailored and effective insurance plans.

Educating Real Estate Professionals about Insurance

Knowledge is power. We’ll emphasize the importance of educating real estate professionals about open house insurance, ensuring they can provide valuable insights to property owners and clients. Real estate agents and brokers should understand the intricacies of insurance coverage, enabling them to guide property owners in selecting appropriate policies.

Continuous education through workshops, seminars, and online courses can enhance their knowledge, making them more competent and trustworthy advisors.

Future Outlook: Innovations in Open House Insurance

As technology evolves, so does insurance. This section will provide a glimpse into the future, discussing potential innovations and advancements in open house insurance that could reshape the industry. Emerging trends such as blockchain technology for transparent transactions, AI-driven risk assessment, and personalized insurance plans based on real-time data are set to revolutionize the way insurance is managed and utilized.

also read: Navigating the Digital Landscape with DigitalNewsAlerts in 2024

Understanding these future developments can help property owners and real estate professionals stay ahead of the curve.

Frequently Asked Questions

Is Openhouseperth.net insurance mandatory for all events?

While not mandatory, it is highly recommended to protect against potential liabilities and damages.

How can I customize my open house insurance plan?

Insurance providers often offer customization options based on the specific needs of the property and event. Consult with your provider to tailor the plan accordingly.

What steps can I take to enhance security during an open house event?

Implementing measures such as professional security services, surveillance systems, and controlled access can significantly enhance event security.

Are there any legal requirements for hosting open house events?

Legal requirements vary by location. It’s essential to research and comply with local regulations to avoid legal issues.

How can technology contribute to a more robust Openhouseperth.net insurance strategy?

Technologies like digital documentation, smart security systems, and data analytics can enhance risk assessment and overall insurance effectiveness.

Conclusion

In conclusion, Openhouseperth.net insurance is a vital component of any successful real estate event. By understanding the coverage options, debunking myths, and staying informed about industry trends, property owners can ensure a safer and more secure open house experience for all parties involved. Comprehensive insurance coverage not only protects against financial losses but also enhances the overall success and professionalism of open house events.